Minera Alamos Acquires Crushing System to Facilitate Future Production Growth at the Santana Gold Project, Sonora, Mexico

Toronto, Ontario and Vancouver, British Columbia— (CNW – January 30th, 2020)

Minera Alamos Inc. (“Minera” or the “Company” or “Buyer”) (TSXV: MAI) is pleased to announce it has entered into an Equipment Purchase Agreement (“EPA”) with Mako Mining Corp., Marlin Gold Mining Ltd. and Oro Gold de Mexico S.A. de C.V. (collectively the “Sellers”) to acquire a complete crushing, screening and agglomeration system for the future growth of the Santana gold project.

“This agreement leverages the financial flexibility provided by our relationship with Osisko Gold Royalties to take advantage of a unique opportunity that presented itself and that will significantly reduce longer term capital and operating costs for the development of the Santana project.” stated Darren Koningen, Minera Alamos CEO. “The acquisition for this excellent collection of equipment is a small fraction of the original purchase cost and underscores our philosophy of finding innovative ways to build our projects with some of industry’s lowest capital intensity.”

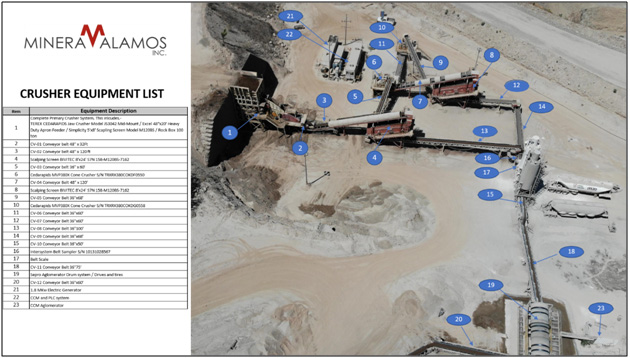

Photo 1 – The Crushing Circuit previously in operation at the La Trinidad mine in Sinaloa, Mexico

Equipment Details and History

The acquired crushing system was originally installed at Mako Mining’s La Trinidad gold heap leach operation and was in commercial service for a relatively short period of time until it was shut down in 2019. The circuit was fully operational up to the point that the operation shut down. Highlights include:

- Design capacity of approximately 300 tph (5,000-6,000 tpd) taking run-of-mine (“ROM”) heap leach material and crushing/screening (three stage crushing) to a fine size passing 3/8”.

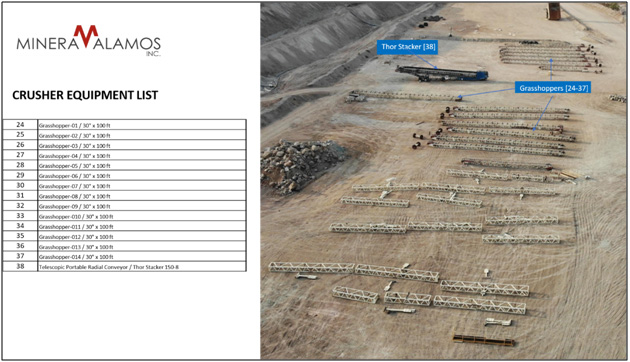

- Also included is equipment to agglomerate the final ore before it was conveyed through a series of portable conveyor sections to a radial stacker which deposited the final material on the leach pad.

- Operations are controlled via an advanced PLC automation package which monitors/controls all individual unit operations from a central control area.

- All the equipment was transported back to the United States after mine shutdown and has been inspected and considered to be in excellent condition.

Opportunities to Minera

The Company is planning to start initial operations at Santana using contractor portable crushing equipment until optimal crushing strategies are better understood. The new system will allow for the Company to transition to a larger capacity crushing operation capable of accommodating Minera’s future plans for significant increases in the production profile at Santana as the overall scale of the project increases through its ongoing exploration. Such a move towards an in-house (non-contractor) crushing system will be significantly less costly as a result of the purchase of the system and is expected to yield significant savings in crushing unit costs. In addition:

- The system as purchased has multiple stages that can easily be rearranged making it flexible to suit whatever arrangement is optimal for the different future ore sources/pits at the Santana project.

- Existing capacity is excellent and can be expanded further by increasing the ultimate crush size that is generated (testwork to date at Santana has demonstrated optimal crush sizes significantly greater than 3/8”). An additional crushing/screening stage(s) could be incorporated to expand capacity even further.

- The PLC control system automation is decidedly beneficial as it allows for easy operation with minimal personnel.

- The system was just recently packaged and shipped to Arizona, U.S. for storage and is in excellent condition to easily ship back across the border to Sonora, Mexico.

Terms of the Equipment Purchase

The aggregate purchase price to be paid to the Sellers is C$1.2 million in a series of staged payments. C$300,000 upon execution of the equipment purchase agreement; C$700,000 on the Closing Date (April 30th, 2020 or such other date on or before September 30, 2020 agreed to in writing by the Buyer in its sole discretion); and C$200,000 on the earlier date of the shipment of the equipment from storage in Pearce, Arizona and June 30, 2020.

Minera is examining finance options that could include a “lease-to-own” arrangement with third parties that will cover the full acquisition cost and will provide additional information in due course on this arrangement should it be consummated as planned.

Photo 2 – The additional stacking equipment included as part of the Crushing Circuit equipment

For Further Information Please Contact:

Minera Alamos Inc.

Doug Ramshaw, President

Tel: 604-600-4423

Email: dramshaw@mineraalamos.com

Victoria Vargas de Szarzynski, VP Investor Relations

Tel: 289-242-3599

Email: vvargas@mineraalamos.com

Website: www.mineraalamos.com

About Minera Alamos Inc.:

Minera Alamos is an advanced-stage exploration and development company with a portfolio of high-quality Mexican development assets, including the La Fortuna open-pit gold project in Durango (positive PEA completed and change of land use permit granted) and the Santana open-pit heap-leach development project in Sonora (permits received).

The Company’s strategy is to develop low capex assets while expanding the project resources and to continue to pursue complementary strategic acquisitions.

Mr. Darren Koningen, P. Eng., Minera Alamos’ CEO, is the Qualified Person responsible for the technical content of this press release under National Instrument 43-101. Mr. Koningen has supervised the preparation of and approved the scientific and technical disclosures in this news release.

Caution Regarding Forward-Looking Statements

This news release may contain forward-looking information and Minera Alamos cautions readers that forward-looking information is based on certain assumptions and risk factors that could cause actual results to differ materially from the expectations of Minera Alamos included in this news release. This news release includes certain “forward-looking statements”, which often, but not always, can be identified by the use of words such as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. These statements are based on information currently available to Minera Alamos and Minera Alamos provides no assurance that actual results will meet management’s expectations. Forward-looking statements include estimates and statements with respect to Minera Alamos’ future plans with respect to the Projects, objectives or goals, to the effect that Minera Alamos or management expects a stated condition or result to occur and the expected timing for release of a resource and reserve estimate on the projects. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration, the economics of processing methods, project development, reclamation and capital costs of Minera Alamos’ mineral properties, the ability to complete a preliminary economic assessment which supports the technical and economic viability of mineral production could differ materially from those currently anticipated in such statements for many reasons. Minera Alamos’ financial condition and prospects could differ materially from those currently anticipated in such statements for many reasons such as: an inability to finance and/or complete an updated resource and reserve estimate and a preliminary economic assessment which supports the technical and economic viability of mineral production; changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with Minera Alamos’ activities; and other matters discussed in this news release and in filings made with securities regulators. This list is not exhaustive of the factors that may affect any of Minera Alamos’ forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on Minera Alamos’ forward-looking statements. Minera Alamos does not undertake to update any forward-looking statement that may be made from time to time by Minera Alamos or on its behalf, except in accordance with applicable securities laws.

The Company does not have a feasibility study of mineral reserves, demonstrating economic and technical viability for the Santana project, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that construction will proceed as planned or that production will begin as anticipated or at all. Failure to commence production would have a material adverse impact on the Company’s ability to generate revenue and cash flow to fund operations.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.