Minera Alamos Announces Maiden Resource Estimate for the Santana Gold Project, Sonora, Mexico

Cerro de Oro Funding Package Update

Toronto, Ontario - (Newsfile – October 3rd, 2023)

Minera Alamos Inc. (“Minera” or the “Company”) (TSXV: MAI) is pleased to announce the results of an independent estimate of the Mineral Resources currently outlined at the Santana gold project (the “Project”) in Sonora, Mexico. The Resource Estimate was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) by Scott Zelligan P.Geo, an independent QP as defined in NI 43-101. A Technical Report with the details of the Resource Estimate will be filed on SEDARplus under the Company’s profile within 45 days of the date of this news release.

“This maiden resource covers just the development zones in the immediate area of the current Santana mine operations and is a major step in highlighting the robust resource data and metallurgical input that provided the Company with comfort in developing our first low capital mine. The next open pit in the development plans for the Project, the Nicho main zone, is largely drilled off in sufficient detail for the estimation of measured and indicated resources with a grade and strip (waste:mineralization) ratio that we expect to provide meaningful low-cost production gold ounces for the next 5-6 years as the rest of the property is explored and better understood” stated Darren Koningen, CEO. “Notable nearby targets such as Benjamin which are outside of our current operations area have shown some excellent potential but will require more preliminary exploration and additional drilling to properly understand mineralization controls, grade distribution and tonnage. Ultimately, this current resource statement is just the first, conservative iteration of the geological potential across the broader Santana property with a goal of the current starter mine being a source of organic funding to prove up the greater potential of the area. “

The Resource Estimate for the Santana gold project – contains 198,000 ounces of Measured and Indicated gold resources (9.61 Mt at 0.65 g/t) and an additional 103,000 oz of Inferred gold resources (5.51 Mt at 0.58 g/t). Table 1 shows the Mineral Resource estimate by zone for the Santana Project.

Table 1 – Santana Gold Project Estimate of Mineral Resources

| Deposit | Category | Tonnes (t) | Gold Grade (g/t) | Contained Ounces (koz) |

| Nicho | Measured | 6,390,000 | 0.65 | 133,000 |

| Indicated | 2,810,000 | 0.64 | 57,000 | |

| Total M&I | 9,200,000 | 0.65 | 190,000 | |

| Inferred | 1,530,000 | 0.66 | 33,000 | |

| Nicho Norte & Divisadero | Measured | 150,000 | 0.66 | 3,000 |

| Indicated | 260,000 | 0.62 | 5,000 | |

| Total M&I | 410,000 | 0.63 | 8,000 | |

| Inferred | 2,470,000 | 0.55 | 44,000 | |

| Benjamin | Inferred | 1,510,000 | 0.54 | 26,000 |

| Total | Measured | 6,540,000 | 0.65 | 136,000 |

| Indicated | 3,070,000 | 0.64 | 62,000 | |

| Total M&I | 9,610,000 | 0.65 | 198,000 | |

| Inferred | 5,510,000 | 0.58 | 103,000 |

Notes to Table 1:

- The independent QP for the mineral resource estimates, as defined by NI 43‑101, is Scott Zelligan, P.Geo. The effective date of the 2023 mineral resource estimate is May 31, 2023.

- A gold price of $1,700/oz was used in calculating the Mineral Resources.

- The estimate is reported for a potential open pit/heap leach scenario.

- The limits of the Resource-constraining pit shell assumed a mining cut-off based on a total operating cost (mining, milling, and general and administrative [G&A]) of $12.00/t stacked, a metallurgical recovery of 75%, and a constant open pit slope angle of 40°. This constraining pit shell contained a total volume of 49 Mt (mineralized + unmineralized) implying a strip ratio of approximately 2.25.

- The gold cut-off grade applied to mineralized material is 0.15 g/t Au

- These Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability.

- The Mineral Resource estimate follows CIM Definition Standards.

- Results are presented in-situ. Ounce (troy) = metric tonnes x grade / 31.1035. Calculations used - metric units (metres, tonnes, g/t). Rounding followed the recommendations as per NI 43‑101.

- The number of tonnes has been rounded to the nearest ten thousand.

- The QPs of the Report are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing, or other relevant issues that could materially affect the Mineral Resource estimate.

Extensive modelling and statistical work was performed to analyze the effect of the oxide zone on gold grade and rock specific gravity. Due to the fractured nature of the host rock, the oxide-sulphide transition zone of the deposits are irregular and difficult to model using conventional wireframing techniques. It was decided for the current Resource Estimate to model without a transition boundary and allow the measured variations to populate the blocks accordingly. Metallurgical testwork (see section below) is ongoing and results from limited sulphide samples tested to date indicate the potential for heap leaching of this material although final required parameters like crush sizes are not yet fully understood. It has been recommended that the Company continue to evaluate the overall database of exploration information with a goal of incorporating geo-metallurgical information into future resource estimates.

Table 2 – Constraining Pit Parameters for Resource Estimation

| Parameter | Unit | Value |

| Gold Price | $/oz | 1,700 |

| Refining Cost | $/oz | 15.00 |

| Process Cost | $/t stacked | 4.00 |

| Metallurgical Recovery | % | 75 |

| General & Administrative | $/t stacked | 0.50 |

| Mining Cost | $/t | 2.30 |

| Gold Cut-Off Grade | g/t Au | 0.15 |

| Pit Slope Angle | degrees | 40 |

Notes to Table 2:

- The parameters listed in Table 2 define a basis for reasonable prospects of eventual economic extraction for the Project Mineral Resource estimate and are in-line with current actual operating costs for the project. The processing scenario assumes heap leaching of mineralized material sourced from open pit mining operations. The Mineral Resource has been constrained to mineralized material that occurs within a pit shell derived utilizing the parameters listed in Table 2. All other material within the defined pit shell was characterized as non-mineralized material.

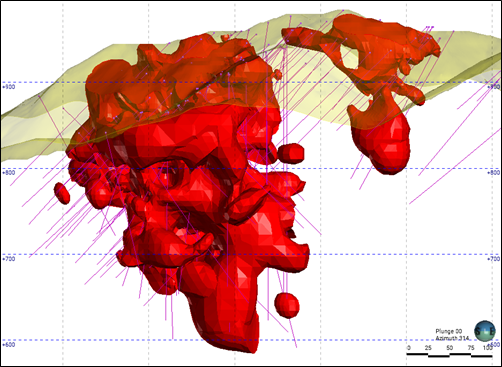

Image 1 - Mineralized Volumes Nicho Cross Section

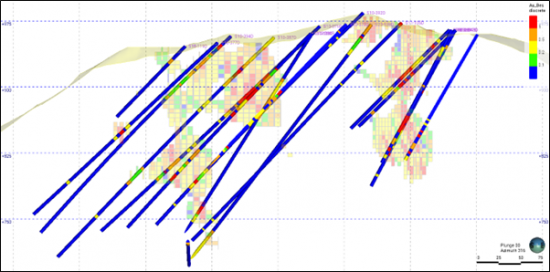

Image 2 - Visual Validation Angled Cross Section Nicho Gold Deposit

Geology and Background

Mineralization in the Santana Project area is of the intrusive-related gold (Au-Ag-Cu-W) type and is associated with calc-alkaline-oxidized intrusive centres (i.e. San Nicolas Batholith). Gold is hosted by hydrothermal breccias and their causative inter-mineral dykes and stocks and can form important mining districts with clusters of deposits. The intense alteration associated with the mineralization is linked to the emplacement of hydrothermal breccias which are in general sub-vertical pipe-like structures and typically a few hundred meters in diameter.

Locally, mineralization at the Santana Project occurs within breccias that have a jigsaw-type texture. These breccias typically comprise angular elongated fragments that have a preferential sub-vertical orientation. Review of core and outcrop indicates that these fragments did not undergo large displacements or rotations, which left open spaces between them that were subsequently infilled by gold-bearing hydrothermal minerals. The breccias are principally clast-supported and monomictic, and the presence of gold mineralization is directly related to the areas dominated by the breccia intervals.

In the case of Santana, there appears to be a cluster of potential gold-bearing deposits that conform to the description above within an area surrounding the main Nicho complex that is the subject of the current gold resource estimate. Further work is planned to properly understand the nature and size of these important targets and to delineate additional mineralization that could allow for prolonged or expanded project operations beyond what has been identified to date.

Metallurgy

The majority of the Nicho gold mineralization that serves as the basis of the current resource estimate is located within an andesitic breccia zone above the deeper quartz-feldspar porphyry intrusive. Mineralization is generally well disseminated throughout the overall host rock volume with small scale enrichment in the fractures between the breccia matrix fragments.

Overall copper content in the mineralization is generally low and leaching results from ongoing operations at the Project indicate that its presence is manageable using free cyanide level-control in the leach solutions, with little impact on overall gold recoveries. The Nicho Norte mineralized material which was the primary source of past test leaching (2017-2019) and recent operations at the Project responds positively to gold cyanidation. Residual gold levels following these heap leaching activities typically approach levels of approximately 0.1 g/t Au. At mined head grades of 0.6 g/t Au to 0.7 g/t Au this equates to gold overall recoveries in the range of 80%. Leach kinetics are rapid for particle sizes up to approximately 1ʺ (30–45 days or less). Although a reduction in kinetics appears at sizes greater than 1ʺ, ultimate gold recoveries at the end of the extended leach period were similar to those experienced with the finer-sized material.

Although more data is available for material from the Nicho Norte satellite deposit, comparative studies looking at test samples from the Nicho main deposit appear to exhibit similar results and additional work is ongoing. Recently tested samples of weathered material from upper zones in the deposit exhibited recoveries in line with the Nicho Norte material described above. Leach tests completed on samples of “worst case” fresh sulphide material from deeper in the Nicho deposit exhibited acceptable gold recoveries approaching 70% at crush sizes of <1/2” (coarsest size used for initial screening tests). Additional testwork is underway to more fully understand the overall gold recovery versus particle size relationships throughout the deposit due to variations in sulphide levels and weathering.

Recommendations

The report recommends that additional diamond drill holes, on approximately 25 m centres be drilled at the Benjamin Zone to further understand the distribution of gold mineralization within the zone and to look at opportunities to expand the size of the currently delineated mineralized area. The Company is currently planning to add approximately 10-12 more drill holes to those already drilled this year at Benjamin as a priority.

Additional recommendations include:

- Further review of the additional mineralized breccia targets which have been identified by the Company in the areas surrounding the Nicho complex (Goldridge, Zata, Bufita and East zones) area in order to prioritize the next phases of follow-up resource definition drilling.

- A continuation of effective surface sampling activities with a focus on new areas that show similar mineralization characteristics as the Nicho and Nicho Norte zones.

- Geophysical studies targeting blind targets that have similar signatures as those observed over the known Nicho and Nicho Norte gold-bearing breccia zones.

- Additional metallurgical studies (particularly crushing optimization studies) aimed at improving the overall understanding of variations in parameters such as leachability, recoveries and reagent consumptions for newly delineated zones of mineralization.

Cerro De Oro Project Financing Update

The Company is also pleased to report that final documentation based on the term sheet for the Cerro de Oro project financing package announced on May 31, 2023, is expected to close shortly, following the completion of final project technical due diligence. Proceeds from the financing package will be used to permit and construct the Cerro de Oro heap leach gold mine. Delays from the original expected closing date of mid-July were largely a function of expanded requirements for the drafting of documentation suitable for both the Mexican and Canadian corporate jurisdictions. The broad business and financial terms outlined in the May 31, 2023 release remain unchanged.

Qualified Person Statements

The Technical Report on the Mineral Resource Estimate for the Cerro de Oro Project was prepared by Scott Zelligan P.Geo., Larry Segerstrom, M.Sc. (Geology), C.P.G. and Peimeng Ling, P.Eng., all Qualified Persons (“QPs”) as defined under Canadian National Instrument 43-101. The QPs have reviewed and approved the content of this news release. All of the QPs are “independent” of the Company pursuant to National Instrument 43-101. The Technical Report will be posted on SEDARplus within the next 45 days.

The listed Qualified Persons have reviewed the data contained in this new release and verified that such data is accurately disclosed.

| Scott Zelligan, P.Geo. |

Zelligan Consulting Inc. |

|

Larry Segerstrom, M.Sc. (Geology), C.P.G |

Segerstrom Consulting LLC |

|

Peimeng Ling, P.Eng. |

Peimeng Ling & Associates Ltd. |

Mr. Darren Koningen, P.Eng. Minera Alamo’s CEO, is the Qualified Person responsible for the content of this press release under National Instrument 43-101. Mr. Koningen has supervised the preparation of, and has approved the scientific and technical disclosures in this news release.

For Further Information Please Contact:

Minera Alamos Inc.

Doug Ramshaw, President

Tel: 604-600-4423

Email: dramshaw@mineraalamos.com

Victoria Vargas de Szarzynski, VP Investor Relations

Tel: 289-242-3599

Email: vvargas@mineraalamos.com

Website: www.mineraalamos.com

About Minera Alamos Inc.

Minera Alamos is a gold production and development Company undergoing the operational start-up of its first gold mine that produced its first gold in October 2021. The Company has a portfolio of high-quality Mexican assets, including the 100%-owned Santana open-pit, heap-leach mine in Sonora that is currently going through its operational ramp up. The 100%-owned Cerro de Oro oxide gold project in northern Zacatecas has considerable past drilling and metallurgical work completed and the proposed mining project is currently being guided through the permitting process by the Company’s permitting consultants. The La Fortuna open pit gold project in Durango (100%-owned) has a positive, robust preliminary economic assessment (PEA) completed, and the main Federal permits are in place. Minera Alamos is built around its operating team that together brought three open pit heap leach gold mines into successful production in Mexico over the last 13 years.

The Company’s strategy is to develop very low capex assets while expanding the projects’ resources and continuing to pursue complementary strategic acquisitions.

Caution Regarding Forward-Looking Statements

This news release may contain forward-looking information and Minera Alamos cautions readers that forward-looking information is based on certain assumptions and risk factors that could cause actual results to differ materially from the expectations of Minera Alamos included in this news release. This news release includes certain “forward-looking statements”, which often, but not always, can be identified by the use of words such as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. These statements are based on information currently available to Minera Alamos and Minera Alamos provides no assurance that actual results will meet management’s expectations. Forward-looking statements include estimates and statements with respect to Minera Alamos’ future plans with respect to the projects, objectives or goals, to the effect that Minera Alamos or management expects a stated condition or result to occur and the expected timing for release of a resource and reserve estimate on the projects. Since forward-looking statements are based on assumptions and address future events and conditions that, by their very nature involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration, the economics of processing methods, project development, reclamation and capital costs of Minera Alamos’ mineral properties, the ability to complete a preliminary economic assessment which supports the technical and economic viability of mineral production could differ materially from those currently anticipated in such statements for many reasons. Minera Alamos’ financial condition and prospects could differ materially from those currently anticipated in such statements for many reasons such as: an inability to finance and/or complete an updated resource and reserve estimate and a preliminary economic assessment which supports the technical and economic viability of mineral production; changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with Minera Alamos’ activities; and other matters discussed in this news release and in filings made with securities regulators. This list is not exhaustive of the factors that may affect any of Minera Alamos’ forward-looking statements. These and other factors should be considered carefully, and readers should not place undue reliance on Minera Alamos’ forward-looking statements. Minera Alamos does not undertake to update any forward-looking statement that may be made from time to time by Minera Alamos or on its behalf, except in accordance with applicable securities laws.

The Company does not have a feasibility study of mineral reserves, demonstrating economic and technical viability for the Santana project, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.